Types of Undergrad Loans

Direct Loans

Federal student loans offered by the U.S. Department of Education (ED) to help eligible students cover the cost of higher education. Find more information about Direct Loans below.

Direct PLUS (Parent PLUS) Loan

Direct PLUS Loans are federal loans that parents of dependent undergraduate students can use to help pay for college or career school. Find more information about Direct PLUS Loans below.

Private (Alternative) Loans

Private educational loans are available from a number of lenders for students whose cost of attendance has not been met with other financial aid. The FAFSA (Free Application for Federal Student Aid) is normally not required to apply for a private loan. Find more information about Private Loans below.

Through the Office of Financial Aid, MSU provides low-interest (7% per year) short term loans to students who are registered for the current semester and who can demonstrate the ability to repay within 60 days. Loans are usually granted in amounts up to $500 for undergraduate students. Find more information about Short-term Loans from MSU in the "Short Term Loans" tab below.

Although student loans are a convenient source of funding for your education, it is important to budget and borrow carefully.

- Consider ways to keep your costs down to reduce student loan debt.

- Borrow only what you need and can reasonably repay.

- Research the average pay of your chosen field by viewing the Occupational Outlook Handbook. It contains information on projected earnings, expected growth rates and typical work environments for most occupations.

- Plan to graduate in a timely fashion. Adding another year of study can add significantly to your debt at graduation. Meet with your academic advisor every semester to plan for efficient progress toward graduation.

- Keep track of your loan debt and the amount you will have to repay when you graduate. Use Studentaid.gov's Loan Simulator to estimate and find the best repayment strategy.

Take very seriously the responsibility of borrowing and repaying an educational loan.

- Read and understand the terms and conditions on your promissory note. You are agreeing to repay the loan with all accrued and capitalized interest and deducted fees.

- It is your responsibility to read and keep all your records and contact your lender regarding any changes in your status as a student.

- You are obligated to repay your loan regardless of whether you complete your education, are satisfied with your education, or are able to find a job.

How conscientiously you make payments on your student loan will affect your ability to borrow for a car, a house, or other purchases in the future. If you are late with your student loan payments, it will have a negative effect on your credit history. On the other hand, repaying your student loan on time can help you establish and maintain an excellent credit history.

Preventing Default

Default is a legal term used when a borrower fails to repay a loan according to the terms of the signed promissory note. For a Federal Direct Student or Parent Loan, default occurs when the borrower fails to make a payment for 270 days under the normal repayment plan, and has not requested deferment of payment according to the Department of Education's standards.

Defaulting on a loan affects not only the borrower, but also the college or university as well as the US taxpayer. The borrower will experience negative consequences to his or her credit rating, garnishment of wages and collection from federal funds such as tax refunds or and even Social Security benefits.

If many borrowers at a particular college or university go into default status, the institution can lose the ability to participate in federal student aid programs, denying future students the ability to receive financial aid to help pay for college.

When borrowers default, the US government eventually must write off the loss, and passes the losses on to the taxpayer, either in the form of higher taxes, higher deficits, or the loss of other programs and benefits that the funds might have been used for instead.

Contact your lender(s) if you are having problems making your payments. You might qualify for a forbearance, which allows you to stop making payments for a time period while keeping your loans in good standing.

Eligibility

To be eligible for a Federal Direct Loan, you must meet the following criteria:

- You must be enrolled at least half-time.

- You must file the FAFSA (Free Application for Federal Student Aid) every year that you are enrolled in school. Most students who apply will qualify for a subsidized or unsubsidized Direct Loan.

How to apply

The Direct Loan application is a three-step process. If you do not complete all three steps, your loan will not be processed.

- View and manage your loan in your student portal.

- Complete the Direct Loan Entrance Counseling process at StudentAid.gov.

- Sign your Direct Loan Master Promissory Note (MPN) at StudentAid.gov. The Direct Loan MPN is good for ten years provided at least one Direct Loan is disbursed to you within the first 12 months after signing.

Differences between subsidized and unsubsidized loans

Subsidized

The federal government pays the interest on a subsidized loan while the student is in school at least half-time. After the student drops below half-time or leaves school, interest will begin to accrue. Students should contact their federal loan servicer for more information.

Unsubsidized

Interest does accrue on an unsubsidized loan while you are in school. You may choose to pay interest while in school in order to avoid "paying interest on interest" (capitalizing interest).

Interest rates

The Direct Loan interest rate varies annually with a maximum rate of 8.25% for undergraduates and 9.5% for graduate students. The interest rate for undergraduate Direct Loans disbursed on or after July 1, 2023 is 5.50%. The interest rate for graduate Direct Loans disbursed on or after July 1, 2023 is 7.05%.

Loan fees

Direct Loans disbursed on or after October 1, 2020 require a 1.057% origination fee which is paid at the time of disbursement. Thus, 98.943% of the gross loan amount will be disbursed to your student account.

Repayment and consolidation

When you near graduation (or drop below half-time), you will be given information on loan repayment and consolidation. This is referred to as exit counseling (or "the exit interview"). For more information, see our page on loan repayment.

Federal Direct Loan programs carry both annual and cumulative (lifetime) limits. The SAR (Student Aid Report) from your FAFSA contains your cumulative borrowing history, and you may also view your entire student loan history online via NSLDS.

Annual Limits

| Maximum Subsidized + Unsubsidized |

Maximum Subsidized | |

| Dependent Freshman | $5,500 | $3,500 |

| Dependent Sophomore | $6,500 | $4,500 |

| Dependent Junior/Senior | $7,500 | $5,500 |

| Independent Freshman | $9,500 | $3,500 |

| Independent Sophomore | $10,500 | $4,500 |

| Independent Junior/Senior | $12,500 | $5,500 |

| Graduate/Professional* | $20,500 | $0 |

| Medical | $40,500 | $0 |

* The annual maximum for graduate students in selected clinical psychology majors may be increased to $31,000 depending upon financial need and cost of attendance.

Lifetime Limits

| Maximum Subsidized + Unsubsidized |

Maximum Subsidized | |

| Dependent Undergraduate | $31,000 | $23,000 |

| Independent Undergraduate | $57,500 | $23,000 |

| Graduate/Professional* | $138,500 | $0 |

| Medical | $224,000 | $0 |

* The graduate debt limit includes loans received for undergraduate study.

What happens if I reach a lifetime limit?

If you reach a lifetime loan limit, you will no longer be able to receive any more of that type of loan. If you exceed the limit, aid already disbursed will be billed back. You will have to find alternate ways to finance your education. Therefore it is to your advantage to borrow only what you need for educational expenses, and to keep track of your cumulative debt. Our advisors are happy to work with you to find ways to minimize your borrowing.

150% Subsidized Loan Limit

Below are the maximum lengths of time for which a student can receive Direct Subsidized Loans depending on their academic program. If a student reaches the 150% Subsidized Loan Limit, they are no longer eligible to borrow any additional Direct Subsidized loans. Also, if they continue attending, they will lose the interest subsidy on their previously borrowed loans beginning on the first day of continued enrollment.

| Length of Degree Program |

Maximum Eligibility Period |

| 2 Years | 3 Years |

| 4 Years | 6 Years |

| 5 Years | 7.5 Years |

Eligibility

First, the student must have a FAFSA on file. Then you may borrow a Parent PLUS loan if:

- You are the parent or stepparent of a dependent student.

- You are not in default on any federal education loans.

- You are a U.S. citizen or eligible non-citizen.

If you are not the custodial parent, you may still borrow a PLUS on the student's behalf.

How to apply

The Parent PLUS application is a multi-step process. If you do not complete each step, your loan will not be processed.

- Go to studentaid.gov. The parent will need to sign in with their FSA ID or create one if needed.

- Complete the Direct PLUS Loan application for Parents. Pay close attention when choosing the correct academic year and period for which you're applying. MSU's School code is 02290.

- Complete a PLUS loan Master Promissory Note (MPN) for Parents. The MPN will be valid for 10 years provided a PLUS loan is disbursed within 12 months of the MPN signing. If the loan is approved with an endorser, the MPN will need to be renewed annually.

When to apply

You should begin the application process 4 to 6 weeks before you need the funds to ensure timely processing. Depending on the time of year, it may take several weeks for the servicer to send notice of your credit approval or rejection.

Applying for maximum

We suggest applying for the maximum amount available to you. You do not have to accept the full amount; you can choose how much you would like to accept in your student portal. If you would like to increase your requested amount later in the year, you can make the change in your portal. You do not apply for a new loan.

Disbursement & Refunds

- If the loan is approved, funds are sent directly to MSU and applied against the student's bill. Any PLUS funds that exceed MSU charges are given as a refund by the Student Accounts division of the Controller's Office.

- Disbursement of Parent PLUS funds depends on when the loan is approved. By law, Parent PLUS funds cannot be disbursed until 10 days prior to the student's first day of class in a semester or summer subterm. If that date has passed and the approval process has been completed, MSU will generally disburse the funds within 2 days of approval.

Counseling

PLUS Counseling is required for borrowers who have an endorser listed on the loan or appeal an original credit decision.

Additional info

For more information on Parent PLUS Loans, including loan limits, interest rate, fees and more, visit studentaid.gov.

Alternatives if you are not approved

These are some options the family may want to consider:

- Parent may be approved with an endorser (co-signer).

- Students may contact the Office of Financial Aid and request a "PLUS replacement," which allows them to borrow an additional amount of unsubsidized Direct (Stafford) Loan.

- Private (alternative) loans may be available.

- You may wish to explore other options such as a home equity loan.

MSU Short Term Loans

MSU provides low-interest short term loans (7% per year). Loans are usually granted in amounts up to:

- $500 for undergraduate students

- $1000 for graduate students

- $1,500 for law students

- $1,700 for medical students

Short term loans are available to students who are registered for the current semester and who can demonstrate the ability to repay within 60 days.

Apply for a Short Term Loan at student.msu.edu. Visit your Student Accounts tile and choose "Short-Term Loans" from the "MSU Loans" option in the left-hand menu. Select the Short Term Loan application from the "Loans" menu at the top right. If you meet the criteria, you will be instantly approved and have your funds direct deposited into your bank account.

COGS Loans

Through the Office of Financial Aid, the Council of Graduate Students (COGS) offers interest-free 60-day loans up to $500 to MSU graduate students. Please visit our the Office of Financial Aid in Student Services Room 252 to apply for a COGS loan. Loans are administered solely by the Office of Financial Aid and are subject to availability of funds and the applicant meeting fund qualifications.

ASMSU Loans

Associated Students of Michigan State University (ASMSU) offers interest-free loans up to $300 through the 6th week of each semester (for undergraduate students only). For more information, visit the ASMSU website.

Repayment

MSU loans not paid by the due date result in a late fee and a hold on the student's account that prevents a student from enrolling or registering for classes, or from receiving an academic degree or transcript. The student must repay the loan in order to have the hold removed.

Payment options

Students may prepay all or any part of the loan at any time without penalty. There are three payment options available:

- Pay Online: ECSI is MSU’s third-party billing service provider. One-time or recurring payments can be set up on Heartland ECSI’s website at https://heartland.ecsi.net/

- Pay in person on-campus by going to Room 110 to make a payment. If the office is closed, there is a drop box located in the circle drive that is checked daily. Include your payment remittance on your most recent monthly bill from ECSI (a third -party billing service provider) with the payment and enclose in an envelope prior to placing in the drop box. checks need to be payable to Michigan State University.

- Mail your payment remittance on your most recent monthly bill with your payment to (checks need to be payable to Michigan State University):

Michigan State University

c/o Educational Computer Systems Inc

PO Box 1287

Moon Township, PA 15108

Private educational loans are available from a number of lenders for students whose cost of attendance has not been met with other financial aid. The FAFSA (Free Application for Federal Student Aid) is normally not required to apply for a private loan.

Private loan programs differ from federal student loans, and also from Parent PLUS or Grad PLUS loans, in several ways:

- Annual and total loan limits are higher than federal student loans.

- Interest rates and fees vary by lender.

- Rates are normally variable and change on a quarterly basis.

- Loan approval and the rate of interest are based on credit approval and approval is not guaranteed.

- Most students will be required to secure a co-signer.

- Loans are not federally guaranteed; therefore, they do not have the same deferment, cancellation and consolidation benefits.

- The terms and conditions for private loans vary greatly.

Michigan State University has partnered with ELMSelect to offer a tool that will help students and families. ELMSelect has collected all private lenders used by MSU students in the past five years. The tool allows you to select lenders that specialize in your area of study, and to compare rates and conditions in order to select the loan product that best fits your need.

When can I apply for a loan?

You should begin the application process 4 to 6 weeks before you need the funds to ensure timely processing.

When will the loan be disbursed to my MSU Student Account?

Disbursement of funds depends on when the loan is approved. MSU policy is to disburse no earlier than 10 days prior to the student's first day of class in a semester or summer subterm. If that date has passed and the approval process has been completed, MSU will generally disburse the funds within 2 days of receiving the funds from the lender (most lenders release disbursements 10 business days after the loan is approved by the school).

Use the ELMSelect comparison tool to find out when repayment begins on your loan, the interest rate, and any other fees.

Loan proration impacts undergraduate students applying for fall graduation who are receiving federal student loans. When a student will complete their degree in the middle of an academic year, federal student aid regulations require that we prorate the loan based on the student's enrollment level for that final semester.

Max loan amounts by fall credit load

Please note that the actual loan amount may be less if a student has reached their annual or lifetime loan limits prior to fall semester. For prorated loan amounts above 11 credits, visit the full table here.

| Number of Fall Credits | ||||||

| 6 | 7 | 8 | 9 | 10 | 11 | |

| Dependent Student | $1,875 | $2,187 | $2,499 | $2,812 | $3,124 | $3,436 |

| Independent Student | $3,125 | $3,645 | $4,166 | $4,687 | $5,207 | $5,728 |

Loan Exit Counseling (The Exit Interview)

When you are prepared to graduate from MSU, we will invite you to participate in Loan Exit Counseling, which you can do in person, by mail, or on the Internet. Loan counseling provides information on what to expect as you begin repaying your loans.

Track your loans

Studentaid.gov lets you look up information about YOUR loans, including how much you owe and who your lenders and servicers are.

Who to contact after you graduate or leave MSU

- For Direct (Stafford) and PLUS loans:

If you borrowed through MSU before Fall 2003 or after Summer 2008, check your loan history on NSLDS to find your loan servicer. The StudentLoans.gov website provides contact information for all Stafford (Direct) and PLUS loan servicers.

- For Perkins, Health Professions, and Institutional loans:

-

- Please be aware that ECSI is our third-party billing service provider. Once you begin repayment, you will receive statements from ECSI. Any questions regarding your loan should be directed to the MSU Loans Receivable Office (http://www.ctlr.msu.edu/COLoans/) at 1-517-355-5140.

- For questions regarding your loan, please contact MSU Loans Receivable (http://www.ctlr.msu.edu/COLoans/) at 1-517-355-5140.

- For private (alternative) loans, refer to your loan applications to find your lender or servicer.

Repayment Plans

Options for repayment of federal loans are discussed here.

Loan Forgiveness Programs

Under certain circumstances, the federal government will cancel all or part of an educational loan. This practice is called loan forgiveness or loan cancellation.

- Federal loan forgiveness, cancellation, and discharge

- Loan forgiveness through volunteer work

AmeriCorps and Peace Corps offer the opportunity to reduce your student loan indebtedness.

Loan Consolidation

Loan consolidation is a new loan that is created by combining two or more federal student loans to reduce the amount of monthly payments and/or extend the loan repayment term. Before considering loan consolidation, you should be aware that if you received special borrower benefits by borrowing through MSU's suggested lenders, you may lose some of those benefits (including reduced interest rates). For more information, see our page on loan consolidation.

Financial Hardship, Deferment, Forbearance, Default

If you are unable to make your student loan payments, there are deferment and forbearance options available. The consequences of defaulting on your student loans are severe, so explore your options BEFORE you default.

More info from the Department of Education on repaying your loans

Additional Helpful Links

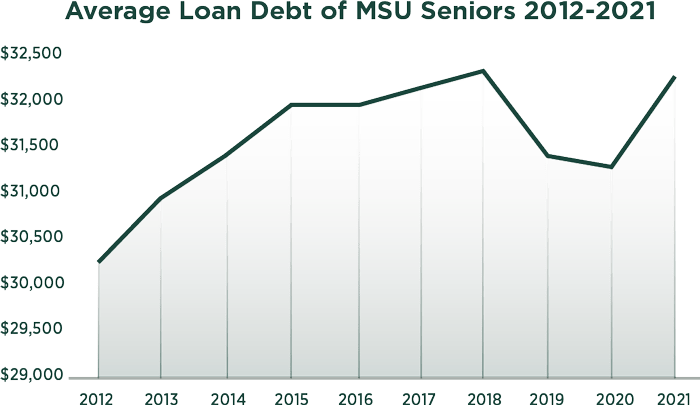

Average Stafford loan indebtedness at MSU

How enrollment level affects financial aid

Before federal loan money can be disbursed, the borrower must sign a Master Promissory Note (MPN). Once signed, the note is good for multiple years (with a few exceptions). If you have any questions, please feel free to contact us.

Federal Direct Loans

The MPNs for the following loans are available at studentaid.gov:

- Direct (Stafford) Subsidized / Unsubsidized Loan

- Parent PLUS Loan

- Grad PLUS Loan

Be sure to correctly specify the type of loan you are signing for, as signing for the wrong loan will delay processing. If you have both subsidized and unsubsidized Direct Loans, you only need to complete one Direct Loan MPN.

If you're looking for Graduate Summer Aid information, go here.

General information about summer sessions can be found on MSU's Summer Study website.There is no separate summer application. Students will be processed for summer financial aid based on actual summer enrollment. Students with a FAFSA application for the current aid year will be considered for available financial aid.

Summer aid eligibility

Students must be admitted into an aid eligible program to receive summer aid.Summer aid and study abroad

If you are planning to study abroad during the summer, contact the Office of Financial Aid about possibly adjusting your budget to account for expenses.Summer disbursement

Summer enrollment periods vary throughout the session, since a course may last a few days or the entire summer. Summer aid disbursement cannot occur until 10 days prior to your first day of summer classes.

Students should finalize their schedules before their first day of class. Dropping courses after starting a course may result in a financial aid bill.